Feel free to jump to the topic that interests you:

Specify and procure FF&E and OS&E at scale with Fohlio today. Empower teams to move faster and improve their operational workflow with specification, prototyping, procurement, collaboration, and analytics tools.

In today's rapidly evolving business landscape, companies seeking growth and competitive advantage often contemplate strategic expansion through integration.

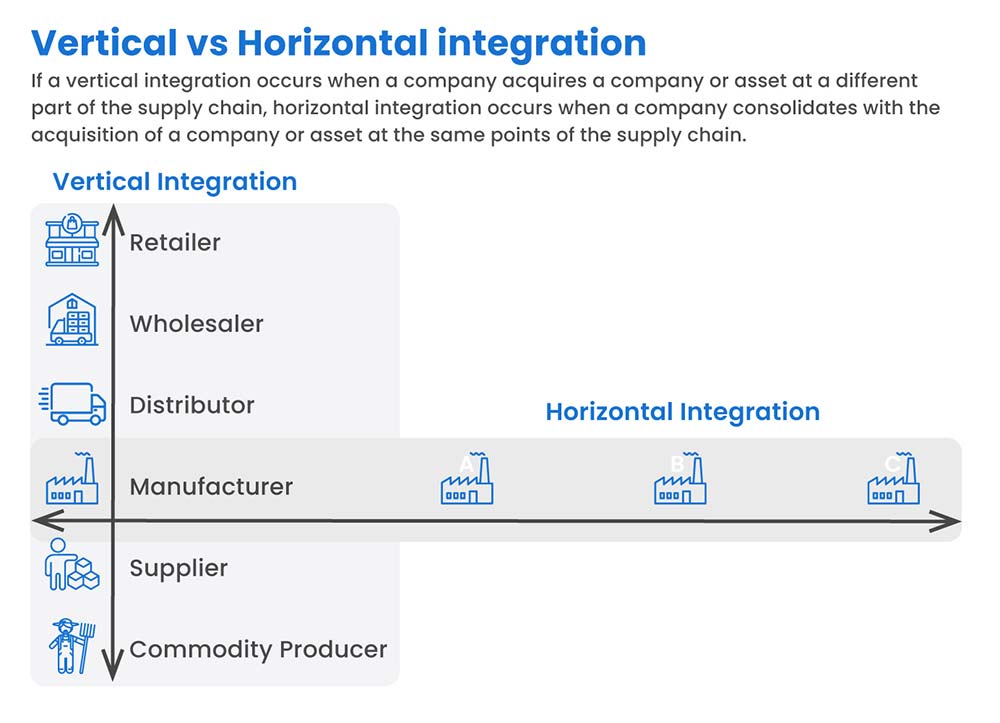

Two prominent approaches, vertical and horizontal integration, have emerged as key considerations. Vertical integration involves controlling various stages of the supply chain, while horizontal integration entails consolidating within the same industry segment.

Image Reference: DealRoom

Understanding the nuances, benefits, and potential drawbacks of these strategies is crucial for executives and decision-makers navigating the complexities of integration. In this article, we delve into the divergent paths of vertical and horizontal integration, shedding light on their distinctive characteristics, associated advantages, and inherent challenges.

Vertical Integration

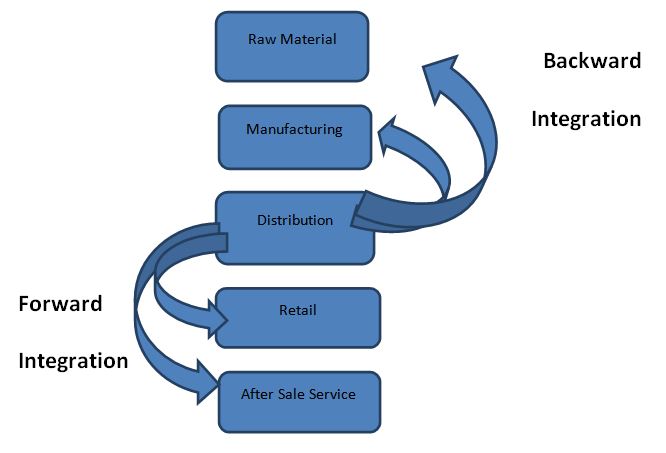

Vertical integration refers to a company's expansion along the supply chain, either backward or forward. It involves acquiring or merging with companies at different stages of the production process or distribution channels.

Image Reference: StudiousGuy

a) Backward Integration: This occurs when a company acquires or controls suppliers or raw material sources. It allows the company to have direct control over its inputs and ensures a stable supply of raw materials. For example, a smartphone manufacturer acquires a company that produces smartphone components.

b) Forward Integration: This happens when a company acquires or controls distribution channels or retailers. It enables the company to have control over its sales and distribution process, ensuring a direct connection with customers. For example, a clothing manufacturer opening its retail stores.

Pros of Vertical Integration

- Control over the supply chain: Vertical integration allows companies to have better control and coordination over their entire supply chain, from sourcing raw materials to delivering finished products.

- Cost savings: Integration can lead to cost savings by eliminating middlemen, reducing transaction costs, and improving operational efficiencies.

- Quality control: Having control over the production process and supply chain can ensure consistent quality standards throughout the value chain.

- Competitive advantage: Vertical integration can provide a competitive advantage by securing essential resources, reducing dependence on external suppliers, and differentiating the company's products or services.

Cons of Vertical Integration

- Increased risk and complexity: Integrating into new areas of the supply chain can expose the company to new risks, challenges, and management complexities.

- High capital requirements: Vertical integration often requires significant investments in acquiring or building new facilities, technologies, or distribution networks.

- Reduced flexibility: Integration may limit a company's flexibility to respond to market changes or adapt to new technologies or trends.

- Lack of expertise: Entering new areas of the supply chain may require different skills and knowledge, which the company may not possess initially.

Tesla: An Example of Vertical Integration

One notable example of a company that successfully implemented vertical integration is Tesla Inc., an electric vehicle (EV) manufacturer led by CEO Elon Musk. Tesla's vertical integration strategy played a crucial role in its rapid growth and market dominance in the EV industry.

Image Reference: Patrick Pleul | picture alliance | Getty Images

Tesla's vertical integration primarily focuses on backward integration, specifically in the areas of battery production and energy storage. Here's how Tesla implemented vertical integration and the advantages it gained:

- Battery Production:

Recognizing the critical importance of batteries in EVs, Tesla sought to have more control over its battery supply chain by vertically integrating backward into battery production. In 2015, the company announced the construction of the Gigafactory in Nevada, a massive facility dedicated to producing lithium-ion batteries. Tesla partnered with Panasonic to co-develop and manufacture the batteries used in its vehicles, such as the Model S, Model 3, and Model X.

Advantages:

- Cost Efficiency: Vertical integration enabled Tesla to optimize the cost structure by reducing dependency on external suppliers, achieving economies of scale, and streamlining the battery production process.

- Quality Control: By controlling battery production in-house, Tesla maintains stringent quality standards and ensures the reliability and performance of its vehicles.

- Technological Innovation: Vertical integration allowed Tesla to collaborate closely with Panasonic and invest in battery research and development, contributing to advancements in battery technology and improving the performance and range of its EVs.

- Energy Storage:

Tesla expanded its vertical integration strategy into the energy storage market by introducing the Tesla Energy division. The company developed and produces the Powerwall and Powerpack, battery systems designed for residential and commercial energy storage applications. With this move, Tesla aimed to revolutionize the energy sector and create a seamless integration between its electric vehicles, energy storage products, and renewable energy generation (e.g., solar power through its acquisition of SolarCity).

Advantages:

- Synergies: Vertical integration allowed Tesla to leverage its expertise in battery technology and apply it to the energy storage market, creating synergies and shared resources across different product lines.

- Competitive Edge: By providing integrated solutions for both transportation and energy storage, Tesla differentiated itself from competitors and gained a competitive edge in the market.

- Market Expansion: Vertical integration enabled Tesla to tap into the growing market for energy storage solutions, extending its reach beyond electric vehicles and diversifying its revenue streams.

Through its vertical integration strategy, Tesla successfully established control over critical components of its supply chain, reduced reliance on external suppliers, and achieved a significant competitive advantage in the EV industry. This integration has helped the company scale its operations, drive technological advancements, and position itself as a leader in sustainable transportation and energy solutions.

Horizontal Integration

Horizontal integration involves the acquisition or merger of companies operating in the same industry and at the same stage of the supply chain. It aims to consolidate market share, increase economies of scale, or gain a competitive advantage by combining similar businesses.

Pros of Horizontal Integration:

- Market power: By acquiring competitors or merging with similar companies, horizontal integration can increase market power and reduce competition.

- Economies of scale: Combining operations and resources can lead to economies of scale, resulting in cost reductions, increased efficiency, and improved profitability.

- Expanded customer base: Integration can provide access to a larger customer base and distribution channels, allowing for increased sales and market reach.

- Synergies and shared resources: Combining complementary assets, technologies, or expertise can result in synergies and shared resources, leading to improved innovation and competitiveness.

Cons of Horizontal Integration

- Regulatory scrutiny: Large-scale horizontal integration may attract regulatory scrutiny for potential anti-competitive behavior or monopolistic practices.

- Cultural clashes: Merging with or acquiring similar companies may lead to cultural clashes, integration challenges, and difficulties in harmonizing operations.

- Integration costs and complexities: Consolidating operations, systems, and processes from different companies can be complex and costly.

- Loss of diversity and innovation: Integration may reduce market diversity and limit innovation if competition and variety decrease.

IKEA+ Geomagical Labs: An Example of Horizontal Integration

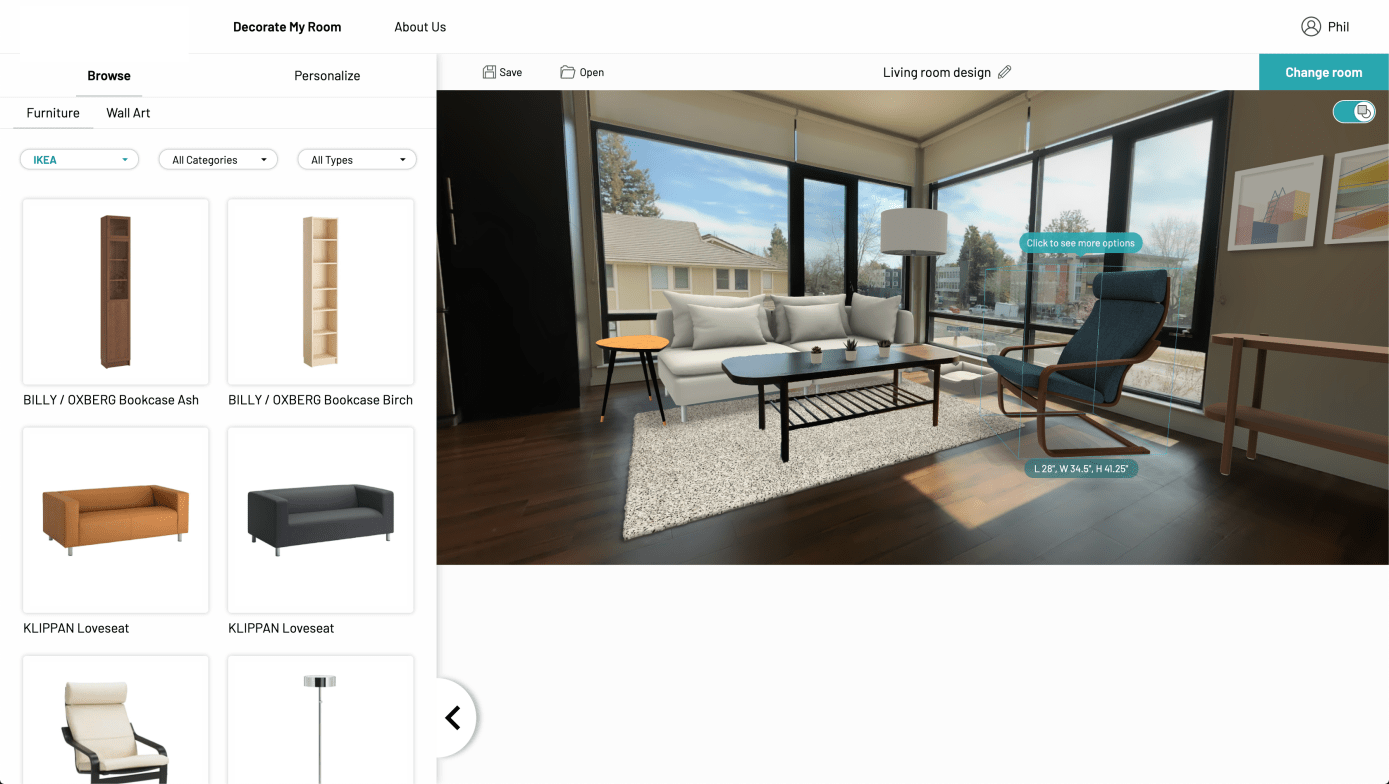

Ingka Group, the company founded by the founder of Ikea and the primary franchisor of Ikea, has been at the forefront of embracing technological innovations that impact the home furnishings and decor giant's business. From early adoption of augmented reality applications to partnerships for smart home devices, and even investments in relevant startups and logistics companies, Ikea has consistently strived to stay ahead in the tech game. In 2020, they took another significant step by acquiring Geomagical Labs, an AI imaging startup headquartered in Mountain View.

Geomagical Labs is a company that developed a range of computer vision-based technologies. Their flagship product allows users to effortlessly scan a room using any smartphone, generating a detailed panoramic 3D picture within minutes.

While Ikea had previously developed an AR-based visualization tool using Apple's AR developer kit, the incorporation of Geomagical Labs' technology takes it a step further, enhancing accuracy and usability. Furthermore, this acquisition provides Ikea with the resources to develop even more features and tools in-house, fueling its commitment to revolutionizing the home shopping experience through innovative technology.

The acquisition of Geomagical Labs provides several advantages to Ikea:

- Enhanced AR Technology: Ikea gains access to Geomagical Labs' advanced augmented reality (AR) technology, enabling customers to visualize and customize interior spaces virtually. This immersive AR experience empowers customers to see how Ikea products fit into their homes, improving decision-making and reducing returns.

- Improved Customer Experience: Geomagical Labs' AR technology enhances the overall customer experience, making the shopping process more engaging and interactive. This can lead to increased customer satisfaction and loyalty.

- Competitive Edge: By integrating cutting-edge AR capabilities, Ikea gains a competitive advantage in the home furnishings market. The innovative technology sets Ikea apart from competitors and attracts tech-savvy customers.

- Digital Transformation: The acquisition accelerates Ikea's digital transformation journey, allowing the company to offer innovative and tech-driven solutions to its customers, catering to evolving consumer preferences.

- Expanded Digital Offerings: Geomagical Labs' technology can be leveraged to develop additional features and tools, expanding Ikea's digital offerings and strengthening its online presence.

- Streamlined Home Visualization: Geomagical Labs' technology streamlines the home visualization process, making it easier for customers to plan and design their living spaces, ultimately increasing conversion rates and sales.

The debate between vertical and horizontal integration as expansion strategies remain ever-relevant in the dynamic world of business.

Vertical integration enables companies to maintain control over their entire supply chain, leading to increased efficiency and potentially higher profit margins. However, it comes with higher initial costs, greater operational complexity, and potential risks if market conditions change.

On the other hand, horizontal integration allows companies to diversify their product offerings, tap into new markets, and achieve economies of scale. Nonetheless, it may lead to challenges in coordinating diverse business units and potential competition concerns.

Ultimately, the choice between vertical and horizontal integration depends on a company's specific goals, industry dynamics, and risk appetite. Striking the right balance between the two approaches can empower businesses to achieve sustainable growth and thrive in an ever-evolving marketplace.

Note: The suitability of vertical or horizontal integration depends on various factors, including the industry, market conditions, company objectives, and available resources. Each approach carries its own advantages and disadvantages, and companies should carefully evaluate their specific circumstances before pursuing integration strategies.

Specify and procure FF&E and OS&E at scale with Fohlio today. Empower teams to move faster and improve their operational workflow with specification, prototyping, procurement, collaboration, and analytics tools.

Expore Fohlio

Learn how to:

- Save days of work with faster specification

- Create firm-wide design standards

- Automate and centralize procurement

- Keep your whole team on the same Page

- Manage product data

- Track budget against cost in real time.

- Prepare for asset valuation

Published May 7, 2024